Uber's $20 Billion Bid for Expedia

Last week, I woke up to the news of Uber potentially acquiring Expedia for a staggering $20 billion. This bold move signals Uber's ambition to become a "super app," a one-stop shop for a wide range of consumer needs. This isn't entirely out of the blue; for the past two years, Uber has been dipping its toes into the travel market by offering flights, trains, & busses in partnership with Hopper & Omio in the UK & Spain market.

This potential acquisition is about more than just Dara Khosrowshahi's previous role as Expedia's CEO or his connection with Barry Diller. In its latest investor presentation, Uber explicitly identified travel as a multi-billion dollar opportunity. The UK experiment seems to be paying off.

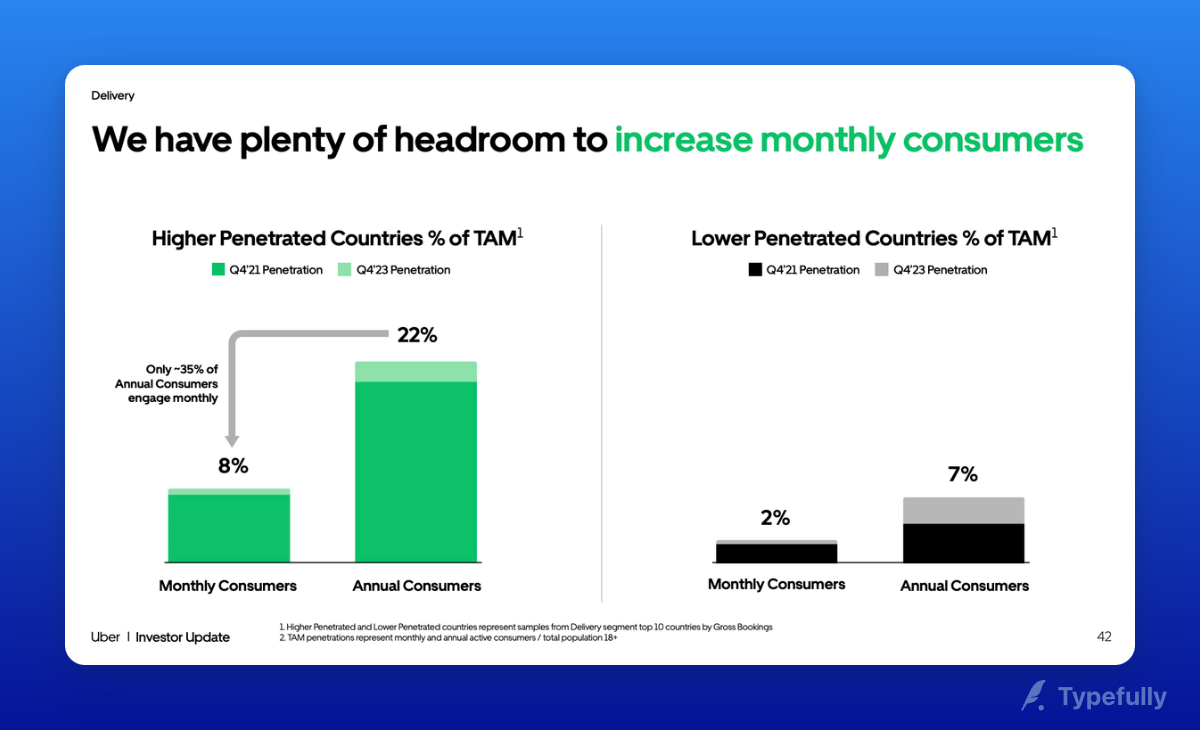

But let's take a step back. Uber acknowledges in its financials that there's still room to grow even in its most established markets, with only 35% of annual users engaging with the app monthly. This brings up an interesting point.

Is Uber Reaching Peak User Growth?

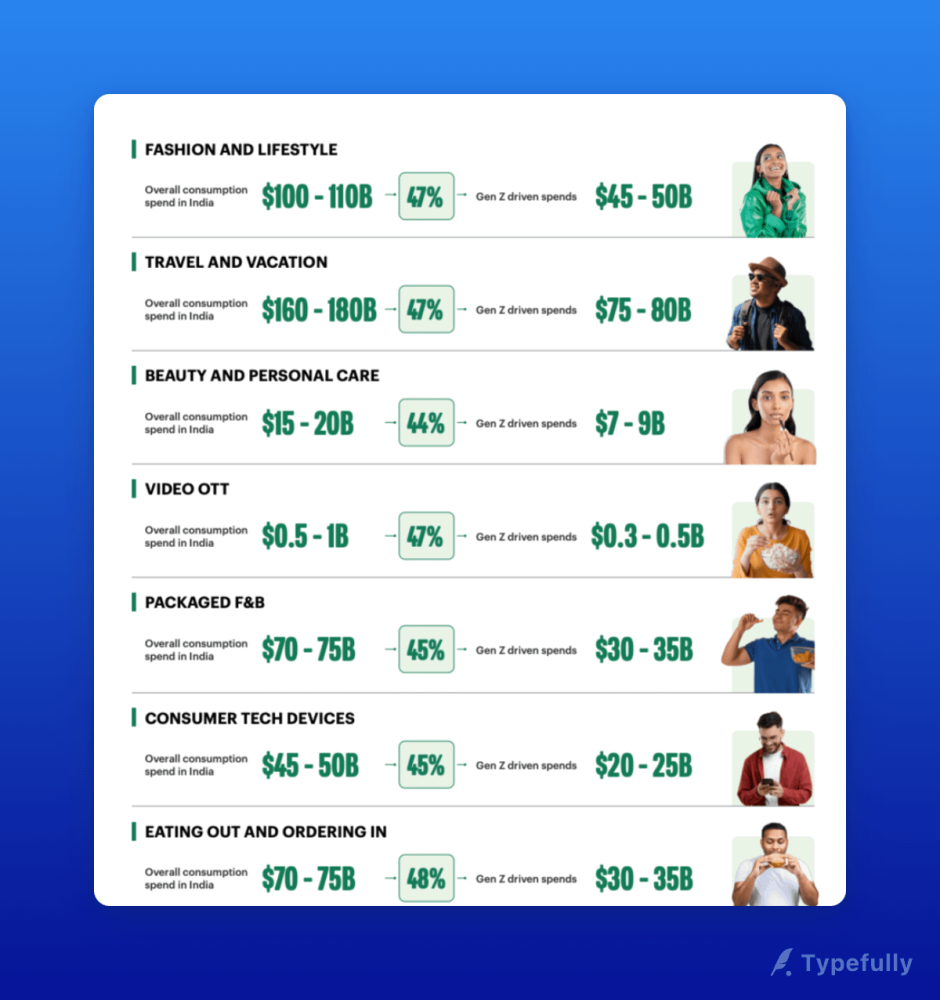

My hypothesis is that Uber has already captured the "early adopter" segment – those with high disposable income and a willingness to try new things. This aligns with what Blume calls "India 1" – a segment that has driven significant consumption growth, particularly among Gen Z. This would have its own equivalence around the world as well.

A recent report by Snap and BCG, "The $2 Trillion Opportunity: How Gen Z is Shaping the New India," highlights that Gen Z now outnumbers millennials in India.

And guess what their top spending category is? Travel.

For Uber, and many established consumer brands, Gen Z is the key to growth over the next decade. They're heavy users of core services like ride-hailing, but what's next? Perhaps this is what Dara is thinking.

Why Travel? Why Expedia?

When user growth plateaus, companies often seek a larger share of their existing customers' wallets by expanding into adjacent markets. This is a classic conglomerate strategy.

Travel is an excellent way to increase share of wallet. So why don't more apps do it? Well, some have. Amazon Pay partners with MakeMyTrip, HDFC SmartBuy with various online travel agents (OTAs), and Paytm previously had a deal with Cleartrip.

However, building a travel offering is no small feat. It requires significant investment in time, money, and resources. Even with partnerships, most companies only get access to an API for inventory. Recreating essential consumer features is a challenge. Many integrated travel offerings lack basic functionalities like calendar view for fares or options to add meals and luggage. For e.g. currently, if you try to book an Air Asia flight on Amazon Pay for Bengaluru to Kuala Lumpur, you will not be able to add luggage in the ticket.

I estimate that a consumer brand in India with high daily and monthly active users would need to spend $2-3 million to build a travel product comparable to leading OTAs. This includes hiring a dedicated team and providing customer support. And that's just the measurable cost; there's also the opportunity cost to consider. Building a competitive travel offering could take 2-3 years, even with a top-notch team.

Uber's Advantage: Acquiring Expedia would give Uber a massive head start. They gain:

- Established Platform: No need to build from scratch.

- Brand Recognition: Expedia is a trusted name in travel.

- Extensive Inventory: Access to a vast network of flights, hotels, and other travel options.

- Data Synergy: Combine Uber's user data with Expedia's travel data for powerful personalization. Imagine travel recommendations based on your ride history!

The Risks of Partnering in Travel:

There's the inherent risk of partnering, especially with another B2C company like Expedia. You become competitors. Earlier this year, Expedia abruptly ended its hotel inventory contract with Hopper in Canada, citing disagreements over Hopper's fintech products. The reality? Hopper was likely growing faster than Expedia, posing a threat.

This acquisition raises questions about Expedia's existing B2B partnerships, which generate $25 billion in GMV. Some of these partners, like airlines or hotel chains, could become Uber's competitors if Uber expands further into travel. Will Uber risk alienating these partners?

High-frequency apps, those used daily or monthly, have the potential to disrupt the travel market. Consider Meituan in China, a super-app used for everything from food delivery to ride-hailing. Because of its frequent use and massive user base, Meituan has successfully expanded into travel and sells more hotel rooms than Ctrip, China's largest online travel agency. This demonstrates how an app with high user engagement can leverage its platform to challenge established players in the travel industry.

This can very well play out in India.

Takeaway:

Imagine a world where you can also buy travel from quick commerce or your favourite credit card comes up with a travel app as comparable as MMT?

How wildly would consumer behaviour change? How will it affect the bottomline, ARPU, & utility of the brand if it who wants to integrate travel?

A lot of times, I get asked by non-travel selling brands wanting to sell travel - "but Ankit, what will be my right to win against an incumbent?" I think the right question to ask is, "How will it strengthen your relationship with your power users?"

If you are someone working in a high DAU/MAU brand & always wondered about this or in a random conversation thought what if we sell travel, we have some great answers, only if you are willing to take this trip together.

OnArrival is building an AWS for travel. We believe that just like AWS made it easy for anyone to operate online, we are making it easy for anyone to start selling travel, at the same level as the leading travel brands in India.

We promise a go-live in 30days or less via a novel integration approach which your product & tech teams will love.

I think I have done well to make this big news about us?

If you connect with me about launching travel I am reachable at ankit@onarrival.travel

Source:

- Uber latest financials - https://s23.q4cdn.com/407969754/files/doc_financials/2024/sr/uber-investor-update.pdf

- The $2 Trillion Opportunity: How Gen Z is Shaping the New India - https://web-assets.bcg.com/87/51/a23cce4443c0bf65422c724a9b73/the-2-trillion-opportunity-how-gen-z-is-shaping-the-new-india.pdf

Member discussion