Indigo's Achilles Heel

Indigo is on its way to becoming the first single-brand airline in the world to cross 200 million passengers carried by 2030. Upon closer inspection, it appears Indigo might achieve this milestone before Ryanair. For FY19, it served 86 destinations, including 24 international, growing to 121 destinations with 33 international by FY24.

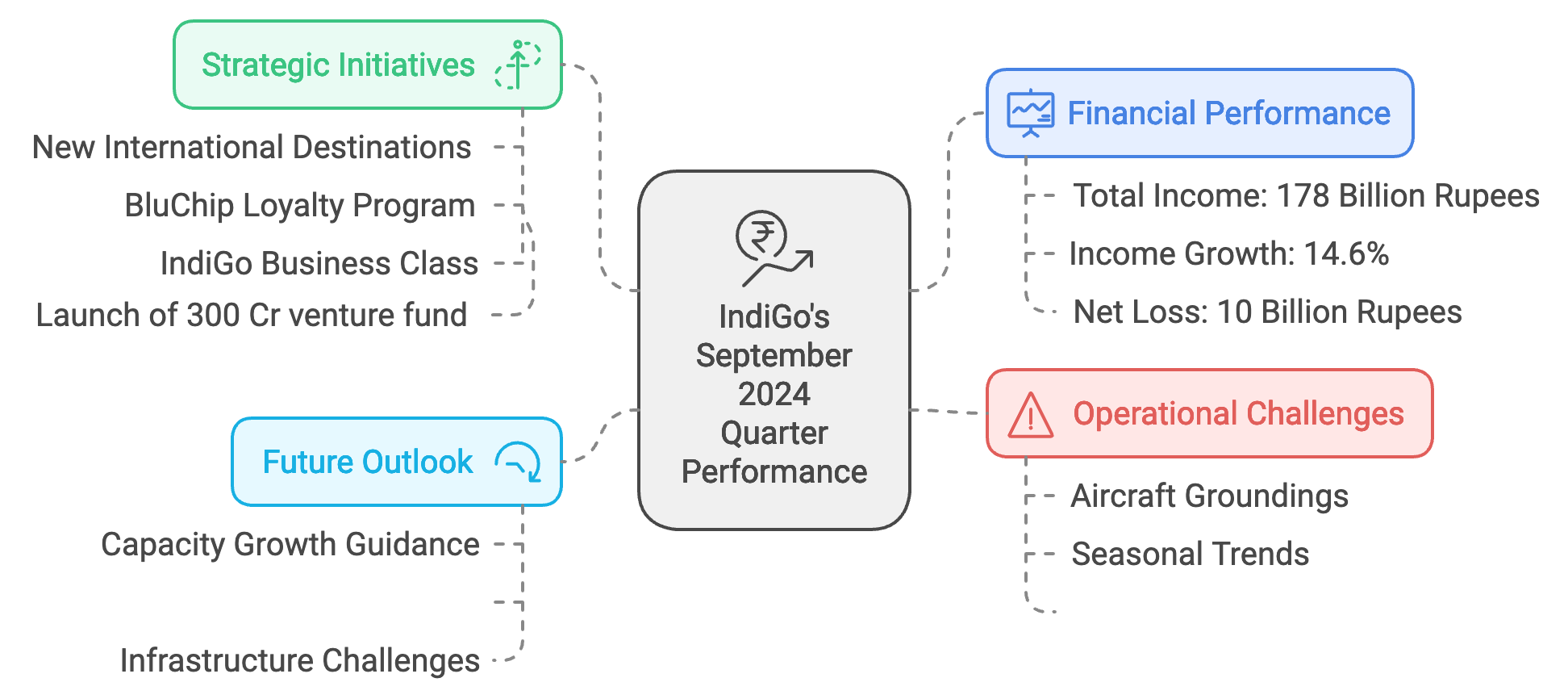

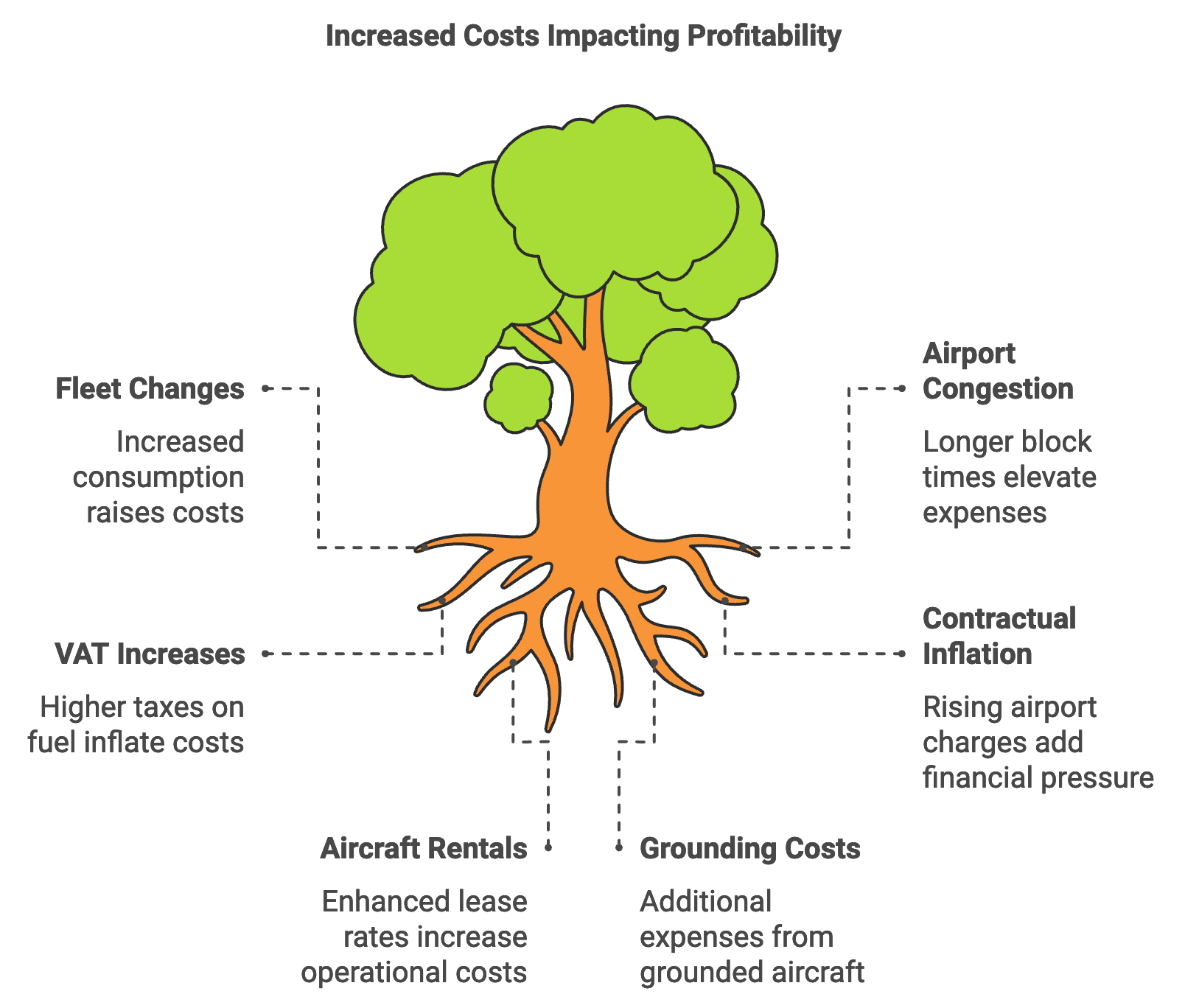

After seven straight quarters of profit, in Q2 FY25, Indigo reported a loss of INR 987 crores on revenue of INR 17,163.3 crores. Revenue increased by 14.6% year over year. Major headwinds included the rising cost of fuel and increased grounding of aircraft.

However, most factors Indigo attributes to these challenges, such as fuel costs and groundings, are global and largely beyond their control. But when you look deeper into Indigo’s revenue, one obvious thing stands out. Their share of ancillary revenue for FY24 was 6.8% in dollar terms.

The Role of Ancillary Revenue for Successful LCCs & Where Is Indigo

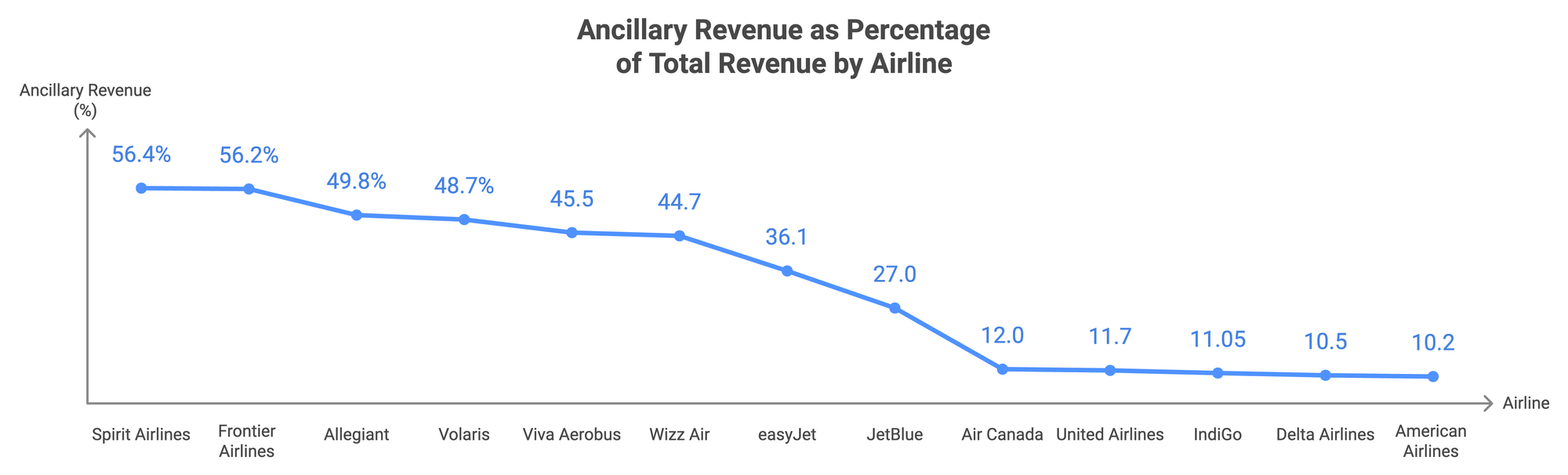

Globally, top-performing LCCs derive a significant share of their revenue from ancillary sources, such as baggage fees, seat selection, and in-flight services. This revenue diversification buffers carriers from fluctuating costs and positions them for stronger financial performance.

IndiGo’s ancillary revenue grew by 20.9% in Q2 FY25, totalling INR 1875 crores, as compared to INR 1550 crores in the same quarter last year. While this growth is promising, ancillary revenue as a share of total revenue still trails that of global LCC leaders. Global ancillary revenue is at $105bn, representing ~15% of total airline revenue. This is critical. One can say that the health of ancillary revenue is a very important indicator of any airline's profitability, especially in the LCC segment.

Below is a comparison of ancillary revenue as a percentage of total revenue for IndiGo and other leading airlines:

This comparison highlights that IndiGo’s ancillary revenue as a share of total revenue (11.05%) is closer to that of full-cost carriers (FCCs) than the top-performing LCCs while charging way less than an FCC. Another consideration is Indigo’s classification of ancillary revenue, which includes cargo, ticket cancellation, and amendment fees, unlike some LCCs that define ancillary revenue strictly as add-on purchases made by travellers.

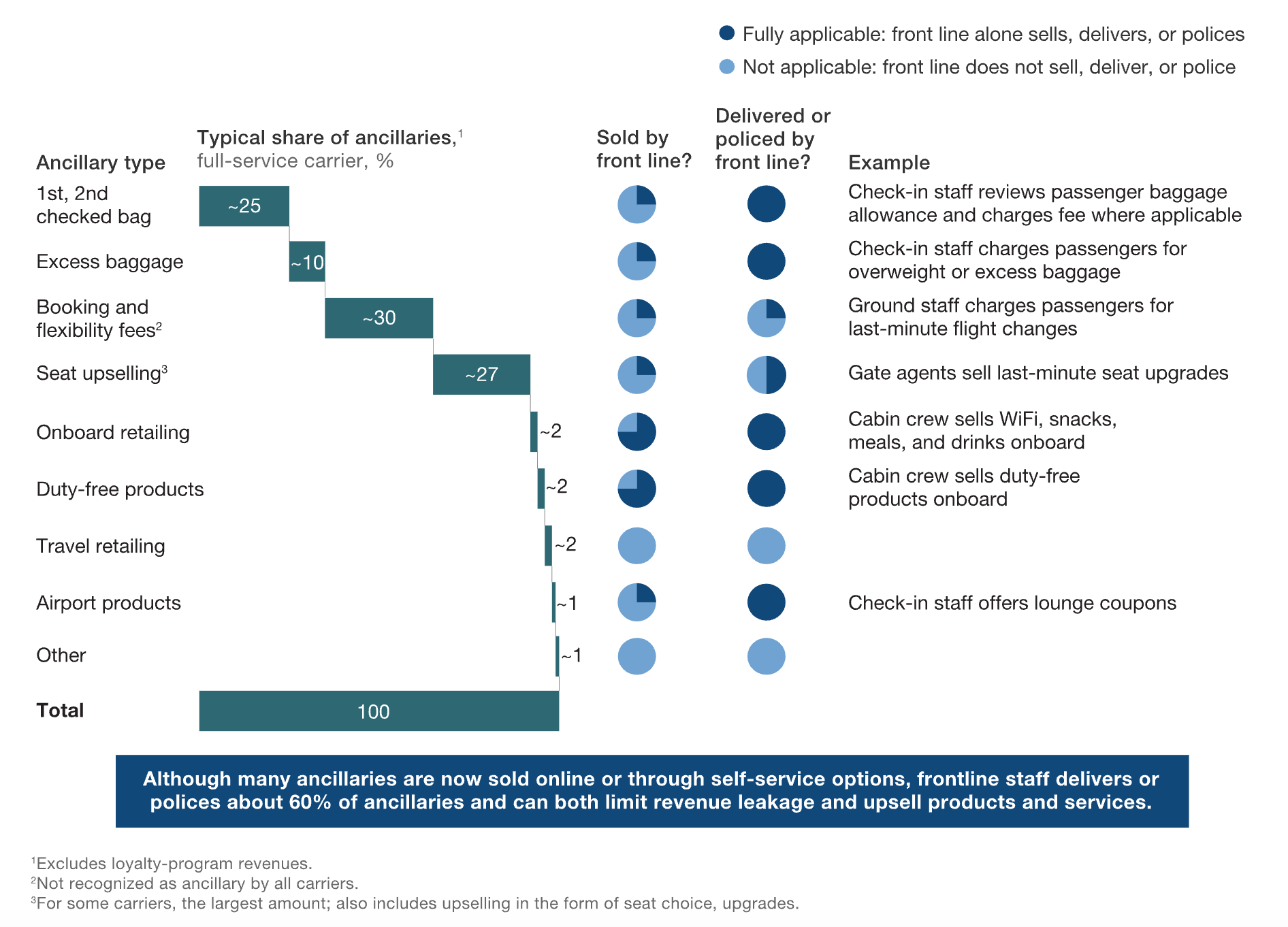

Mckinsey below has created an overview of major ancillaries being sold, where, and by whom. This will give you an insight into where things are heading and the work Indigo has to put in to make the money-counting machine go bur!

Looking to Global LCC Success Stories

Globally, LCCs like Ryanair (40% of total revenue from ancillary sources) and easyJet (36.1%) showcase the impact of successful ancillary revenue models, leveraging dynamic pricing for add-ons like baggage and fast-track boarding. IndiGo can adapt elements of these strategies to its model to enhance its ancillary revenue mix.

Long-Term Profitability Through Ancillary Revenue

As IndiGo grows, an intensified focus on ancillary revenue could create a self-sustaining financial ecosystem that buffers the airline from external volatility. IndiGo’s recent investments in technology and digital transformation, including website and app upgrades, position it to seamlessly integrate new ancillary options and meet the demands of a diverse customer base.

With a clear plan to grow ancillary revenue, IndiGo has the potential to replicate the success of LCC giants, ensuring long-term profitability and financial resilience. As India’s aviation leader, taking inspiration from global LCC models could be the key to driving IndiGo’s next chapter of growth.

India Story

These excerpts from the MMT’s Q2FY24 earnings calls present the India opportunity quite well:

According to the latest report by McKinsey, India is poised to witness one of the most rapid increases in travel expenditures among the world’s top 10 countries from a travel spending figure of $150 billion in 2019. Travel expenditures are anticipated to reach [$410 million], making India the fourth largest global spender on travel by 2030. On the other hand, according to WTTC, the travel and tourism sector contributed 7.6% to the global GDP in 2022. While in India, it accounted for 4.5% of the GDP, reflecting a huge headroom for growth. The contribution of the travel and tourism industry to India’s economy is growing steadily, generating substantial revenue and employment opportunities across various sectors, including hospitality, transportation and local businesses.

We expect travel and tourism in India to grow faster than the overall GDP during the next decade, which should act as a tailwind for the overall industry. A large part of this growth will be led by the aviation and accommodation sector. This is corroborated by the fact that all major airlines have placed a record number of orders for new planes and all major hotel chains have announced the addition of new properties, which will help in supply expansion for many years to come. Homestay supply is also growing in the country with people investing in secondary homes to be used as homestays in key leisure destinations in the country. According to the Government of India forecast, the current 145 million air passengers in India are projected to rise to 425 million by 2025.

Indigo has to balance the domestic market, international expansion, & ancillary to be profitable consistently. Unlike Achilles in mythology, I am confident that Indigo will address this Achilles’ heel, transforming it into an opportunity for sustained growth.

Member discussion